The Race to a Billion Dollar Companies: Who Got There Fastest

In the evolving landscape of technology and commerce, the race to reach $1 billion in revenue serves as a benchmark for entrepreneurial success. The time it takes for a company to achieve this milestone can be influenced by various factors, including market demand, innovation, competition, and effective scaling strategies. Let’s delve into the fascinating journey of the companies that reached this significant mark the fastest, revealing what they did right.

Google and Amazon: The Speed Champions (5 Years)

Google and Amazon stand out as titans that both reached the $1 billion revenue mark in just five years. Google, founded in 1998, leveraged its search engine dominance to monetize through advertising, introducing Google Ads in 2000. Its simple interface and powerful algorithms attracted millions of users, quickly converting them into revenue.

Similarly, Amazon, launched in 1994 as an online bookstore, diversified its offerings rapidly. Jeff Bezos’s vision of creating an “everything store” meant that by the late 90s, the company was already generating substantial sales from books, electronics, and more. This strategic expansion enabled Amazon to capture significant market share and secure its billion-dollar status.

Table of Contents

Apple, Facebook, and Uber: The Next Wave (6 Years)

Following closely are Apple, Facebook, and Uber, each hitting the billion-dollar mark in six years. Apple’s story is unique; the introduction of the iPod in 2001 changed the music industry, paving the way for future innovations like the iPhone. This device not only revolutionized how we communicate but also transformed Apple’s revenue model, boosting sales significantly.

Facebook, launched in 2004, capitalized on the social media boom, amassing millions of users and generating revenue primarily through advertising. Its ability to engage users and create targeted ad opportunities allowed it to reach $1 billion in a short time frame.

Uber’s ascent in the ridesharing industry showcases the power of disruption. Founded in 2009, its app-based platform tapped into the growing demand for convenient transportation, allowing it to scale rapidly in urban markets, leading to its billion-dollar milestone.

The SevenYear Stretch: Airbnb, Spotify, Home Depot

Airbnb, Spotify, and Home Depot, each clocking in at seven years, illustrate different facets of market entry and growth. Airbnb, founded in 2008, revolutionized the hospitality industry by enabling homeowners to rent out their spaces, effectively creating a new category of travel accommodation.

Spotify, launched in 2006, tapped into the shift from ownership to access in music consumption. Its freemium model attracted millions of users who later converted to paying subscribers, driving rapid revenue growth.

Home Depot, a giant in home improvement retail, utilized a different approach focused on customer service and product variety, growing steadily in a niche market. Their strategy of creating a highly knowledgeable staff and offering a wide range of products played a crucial role in their quick financial success.

Eight to Ten Years: A Mixed Bag of Giants

Companies like Twitter, Coinbase, Netflix, Ford, and others that took eight to ten years reflect various industry dynamics. Twitter, which gained traction with its microblogging platform, was able to monetize through advertising but faced challenges in user growth and retention.

Coinbase, a key player in cryptocurrency, capitalized on the explosive growth of the sector post2017. Its platform allowed users to buy, sell, and store cryptocurrencies, quickly attracting both individual and institutional investors.

Netflix’s journey is a tale of transformation from DVD rentals to streaming services. This shift required significant investment in technology and original content, which eventually paid off in subscriber growth.

The Slow Burn: Legacy Brands and Their Timelines

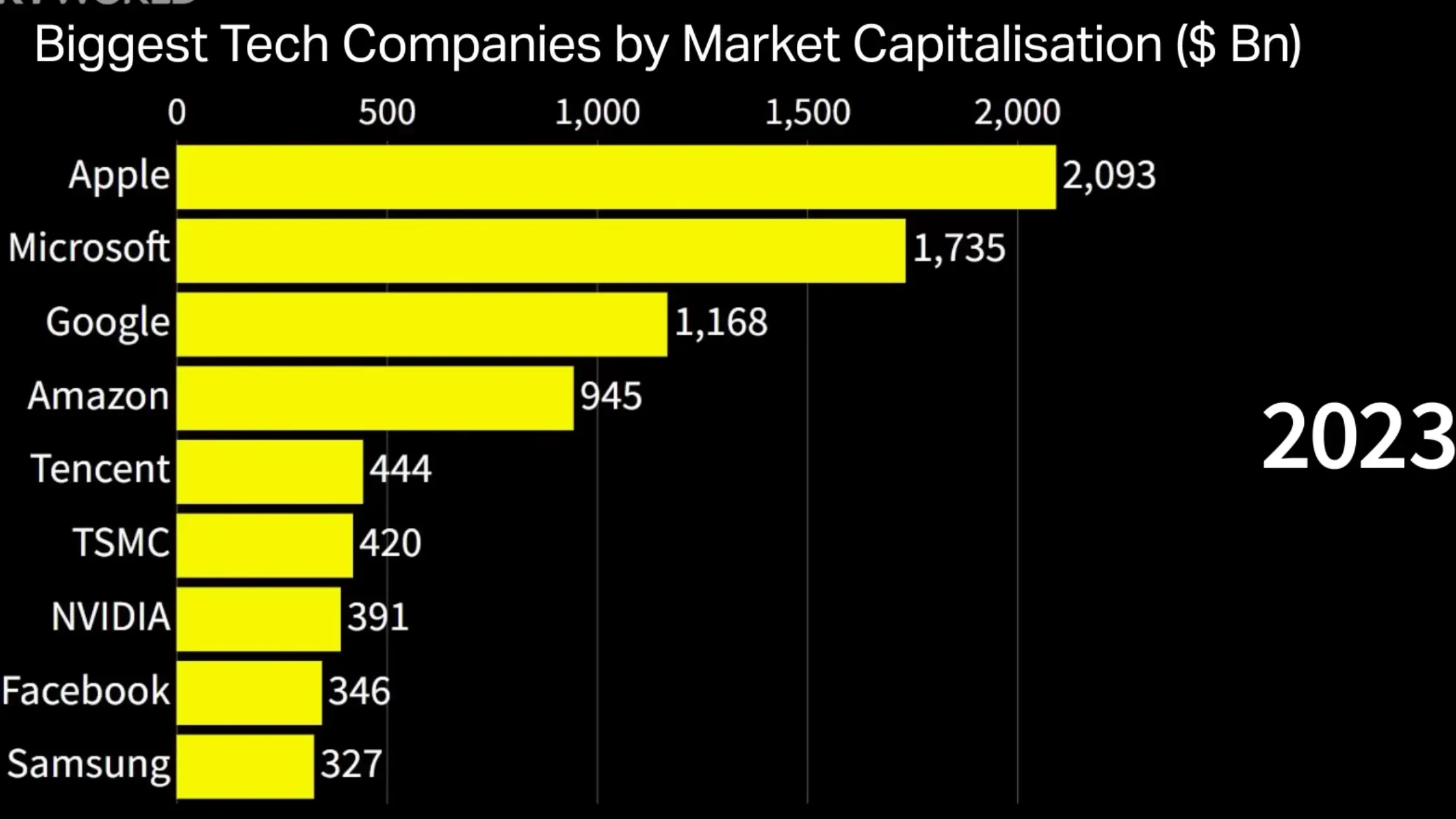

While the rapid growth of newer companies is impressive, traditional giants like Walmart, Microsoft, and Nike took notably longer—between 13 to 30 years—to reach $1 billion. Walmart’s focus on supply chain efficiency and low prices established it as a retail powerhouse, while Microsoft’s software dominance grew alongside personal computing.

Nike’s evolution from a small shoe company to a global brand took time, emphasizing marketing and athlete endorsements while developing a loyal customer base. Similarly, Starbucks, with its focus on creating a unique coffee culture, took 25 years to reach the billion-dollar mark, demonstrating that passion and brand loyalty can sometimes lead to slower but sustainable growth.

The Longest Journeys: Disney, IBM, and Mastercard

At the other end of the spectrum, companies like Disney, IBM, and Mastercard took decades—ranging from 30 to 45 years—to hit the billion-dollar threshold. Disney’s story is one of innovation in entertainment, starting with animation before expanding into theme parks, merchandise, and more.

IBM’s journey through technological evolution and market shifts required adaptability, and Mastercard’s growth in the financial services sector relied heavily on building trust and a global network.

Conclusion: Lessons from the BillionDollar Club

The varied timelines for reaching $1 billion in revenue reveal important lessons for aspiring entrepreneurs. The importance of timing, market need, and innovation cannot be overstated. Companies like Google and Amazon succeeded due to their first-mover advantage in rapidly growing markets. In contrast, traditional firms remind us that building a legacy brand often takes time and a steadfast commitment to quality and service.

Ultimately, whether it’s the rapid ascent of tech startups or the gradual growth of established brands, each company’s journey offers valuable insights into the diverse paths to success in the business world. The race to a billion continues, and with it, the potential for innovation and disruption remains as vibrant as ever.